Are you facing unexpected expenses or cash flow shortages? Look no further! SGI QUICK FUND is here to provide quick and reliable financial solutions.

Get in Touch

-

Phone

+990-737 621 432

-

Email Now

info@example.com

-

Canada Office

Canada City, Office-02, Road-11, House-3B/B, Section-H

Get Quick Cash with SGI QUICK FUND!

SGI QUICK FUND LOANS.

WHO WE SERVE

INTEREST RATES

We offer affordable and competitive rates based on your credit profile and provided collateral.

One week 10%

Two weeks 15%

Three weeks 25%

Four weeks 30%

For loans starting from 1.1 million rates are negotiable based on provided collateral

Contact Us NowWhy Collateral Based

Getting a loan without holding a collateral requires a lot of paperwork.

This includes a stamped letter from a church or clergy, a letter from a local chief, proof of citizenship, employment verification, and more. However, our institution simplifies this process by offering collateral-based loans. This means that instead of gathering numerous documents, borrowers can simply provide a valuable asset as collateral to secure a loan, allowing clients to access funds in just a few minutes.

About More-

1000

+Individuals and businesses benefited

Accepted Collateral.

Follow collateral procedures so that you may not lead us into KATAPILA

Cars

- Cars

Phones

- Phones

Laptops and Desktops

- Laptops and Desktops

Sound Equipment

- Sound Equipment

Printers

- Printers

Fridges and Cookers

- Fridges and Cookers

Pressure pump

- Pressure pump

Electrical generator

- Electrical generator

Welding machines

- Welding machines

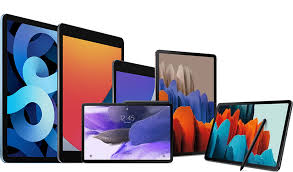

Apple and Android tablets

- Apple and Android tablets

Our Services SGI

Creating a concise and effective designstudio brief is crucial for outlining your business.

Emergency Loans

Quick cash for urgent personal or business needs.

Collateral-Based Financing

Loans secured with valuable assets, simplifying the approval process.

Flexible Repayment Plans

SGI QUICK FUND offers fast emergency loans, simple collateral-based financing, to help you access funds quickly and easily.

FOR SGI QUICK EMERGENCY LOAN PROCEDURE

01 :

Snap pictures of Collateral

Take clear pictures, disclose any problems the asset has to avoid being sent back when you meet with one of our officers.

02 :

Send to 0997997623

The asset to be used as collateral is checked on market places then average and doubled policy is applied.

03 :

Show proof of ownership

Provide documents or witnesses that the asset you are to use as collateral is yours.

04 :

Wait minutes for Assessment

Our team evaluates your asset value within minutes

05 :

Get loan amount agreement

Recieve your approved loan offer and finalise the deal

Note :

Terms and Conditions Apply

CLIENT FEEDBACK

Feedback plays a crucial role.

Our clients trust SGI Quick Fund

I got approved in under 10 minutes and had the cash the same day. SGI QUICK FUND saved my business!

Peter M

The loan terms were clear and the process was straight forward. I knew exactly what to expect -no hidden fees

Grace T

Catch, CTOAPPLY FOR LOAN BELOW

Fill out the form below . Our team will review your application and contact you within 24 hrs

WORK ETHICS

Transparency

Clear loan terms and conditions

Confidentiality

As long as collateral. has been held, everything is confidential.

Security

Your collateral is safe with us

FAQ

Frequently Asked Question

Find clear answers about our loan services ,requirements , and repayment terms

1. What services does SGI QUICK FUND offer?

We provide quick, collateral-based loans with fast approval and flexible repayment terms. Our services include emergency loans, short-term business loans, and personal loans for individuals with a stable income.

2. Who can apply for a loan?

We serve business owners, salaried employees, entrepreneurs, and anyone with a reliable income source who can provide acceptable collateral.

3. What makes SGI QUICK FUND different from other lenders?

We approve loans within minutes, require minimal paperwork, and maintain strict confidentiality. Our collateral-based approach allows clients to access funds quickly without lengthy trust or credit checks.

4. How does your repayment and interest rate system work?

We offer flexible repayment periods from 1 week to 1 month, with affordable interest rates starting at 10%. For loans above 1.1 million, rates are negotiable based on the collateral provided.